This week continues our series on dividends and dividend growth stocks. This is one part of my strategy to try to get through what I see as a coming crisis by the end of the decade with as much of my buying power as intact as possible.

As before, David Bahnsen will be writing this section, and who better? He literally wrote the best and easiest to read book on dividend growth strategies, The Case for Dividend Growth. The many Amazon reviews reflect my own admiration. I let David and his research team pick my dividend growth stocks because I really don’t like exhaustive research on scores of stocks and they are really good at it. You can, however, read his analysis and do it yourself, if you are so inclined.

But before we dive into dividends, let me share some new additions to the Strategic Investment Conference. Our 20th anniversary event is really shaping up into something special. I think I have done more work on setting up this conference than any of the previous 19. What a lineup. I can’t wait to hear the inimitable Felix Zulauf, legendary Swiss money manager and billionaire whose macro views have been uncannily right over the last decades. Always one of the highest-rated speakers, this will be one presentation you will want to review again on video and through the transcript. And Grant Williams as interviewer will get the best out of Felix.

Here's a name you likely do not know. Britt Harris just retired at the CEO of the University of Texas/Texas A&M University Investment Management Company’s $60+ billion endowment fund. He was also CEO of Bridgewater, then ran the $140 billion Teacher Retirement System of Texas. He has won more awards and honors than I can list. He was ranked by Chief Investment Officer magazine as one of the "most influential and powerful asset owners on earth.” His inside knowledge is riveting. Both Britt and Felix will also be on the final panel with Bill White, former Chief Economist for the Bank of International Settlements and my favorite central banker.

An all-star China panel. Inside baseball on AI from the people who are creating it. Commercial real estate insider pros. The latest news on the biotech and anti-aging front. I look at the list and smile as the speakers most likely to blow you away are the ones you don’t know.

This is one year you don’t want to miss. It is virtual so you can watch live, review the presentation at your leisure, listen as audio podcasts or read the transcripts. The conference is five days between April 22-May 1. You can view the entire lineup here and sign up to attend. Don’t procrastinate. Join me as we think about going Into the Storm.

And now, speaking of getting through the storm, let’s learn from the dividend growth master David Bahnsen:

Sailing to the Future with Dividends

Last week’s theme was the defensive nature of dividend growth investing—defense against irresponsible fiscal policy, distortive monetary policy, and destabilizing geopolitical realities. I approached this from a couple of different perspectives:

- Mathematical, as the greater portion of one’s return coming from something that cannot be less than 0%, the less volatile the return will be; and

- Structural, as companies in a position to grow their dividends year after year after year are inherently more stable, reliable, and defensive.

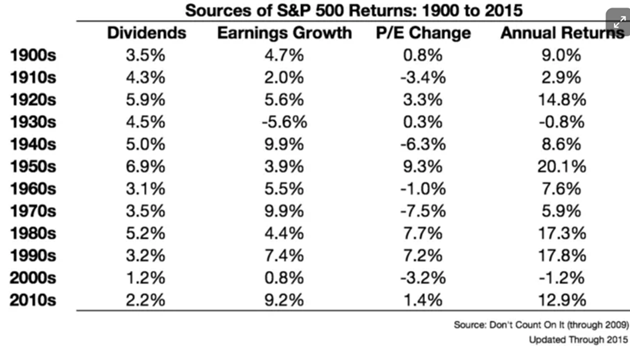

I made the case that what investors are largely defending against in the macro are fiscal, monetary, and geopolitical uncertainties and that conventional means of investing (a 60/40 portfolio, for example, or general use of a S&P 500 index fund) are wholly inadequate for the case at hand. Dividends have gone from being 30‒50% of the return of the market (and that is in good decades; they can be over 100% of the return in a bad decade like the 2000‒2009 era) to just 10‒15% of the expected return now (that is, a 1.2% yield from an asset class with a historical return of 10%). Index investors are asking multiples to expand and earnings to grow more than they ever have, and they are doing so right now from a vantage point of extremely stretched valuations, and a quite robust place of corporate profits.

Source: David Bahnsen

If John hadn’t already done such an outstanding job week after week for many years making the case I would spend more time on it here, but understanding the return attribution of index investing is not complicated. The earnings of an entire index go up a lot more than they go down because capitalism works, and because company managers get fired when they don’t grow earnings. Earnings can contract in an entire index, and profit contraction is sort of a textbook part of what makes for a recession. That contraction can be violent when the recession is especially severe (i.e., 2008 Global Financial Crisis), but fortunately we do not experience a high frequency of severe recessions. However, indexes get their aggregate price growth from the multiplication of the profits achieved by companies in the index by the “multiple”—that elusive but all-important variable that represents what an investor will pay for the future earnings of the company. A high valuation is expensive for a buyer but is appreciated by the seller and really by a holder as well. The problem is that superlative return results from an index require both earnings growth and multiple expansion.

The total return of the index can be summarized as follows:

Earnings per share growth * Change in multiple + Dividend yield

Or in formula form:

TR = ((1+EPS) * (1+PE)) + DY

Earnings per share are, of course, a by-product of sales per share and profit margins. Margins have expanded significantly over the last decade. One has to have a very optimistic view of both margins and margin expansion, and of course revenue growth, to feel that earnings will outperform expectations in the years ahead. And notice I said “earnings,” and not “earnings per share.” For the index investor the formula is “earnings per share,” meaning the share count matters.

Let’s review all the inputs that we have now said matter to the index investor for the decade ahead as it pertains to a return expectation and add a little commentary by each.

- Revenue/sales—It is fine to believe revenues will grow and even potentially grow in line with expectations. But if one believes in the economic logic of revenue growth being correlated to economic growth, and one believes that excessive government indebtedness takes away from future economic growth (something I believe to be tautologically true), then one can be forgiven for not accepting the party line on top-line revenue expectations.

- Profit margins—Operating margins have gone from below 8% to around 12% today. Profit margins have grown more or less in tandem. It has been a huge source of market returns since the GFC. Are margins able to hold here with unprecedented need for more capital expenditures, research and development, and business investment? Are wages shrinking? Are health benefits shrinking? There is no question there are areas in which efficiencies have enabled margins to reach these levels, and perhaps they can hold. I would not consider that thesis a slam dunk, but it is not out of the question that today’s high margin levels hold. But that brings us to the next term…

- Margin expansion—Even if one optimistically believes that margins hold at these breakneck levels, do we have sufficient reason to believe margins expand still more? Should our investment philosophy depend on believing in such? Will deglobalization expand margins or potentially shrink them? Will onshoring expand margins or potentially shrink them? Does populism indicate higher wage costs or lower wage costs? [Note: I am well aware of the argument that greater technological advancements may represent a push to the pull of this argument, which is why I might be comfortable conceding level margins to where we are now, but additional margin expansion in the face of these headwinds seems highly unlikely to me.]

- Share count—Earnings grow where revenues grow and/or margins grow, but for investors to feel that, it must be mathematically applied to the number of shares the total earnings are being applied to. A high level of buybacks reduces share count and therefore expands earnings per share regardless of underlying earnings growth. Congress in its infinite wisdom has passed a 1% tax on buybacks which reduced corporate earnings per share by 0.40% last year. Buybacks had reached $1 trillion over the 2022 fiscal year but ended 2023 at $795 billion. Downward pressure on buybacks is here, and Congress is just getting warmed up. We must remember that the share count does not go down when companies effect buybacks in one end of the pool but issue new stock for employee compensation in the other end of the pool.

- Earnings per share—Effectively, one has multiple inputs that may face downward pressure, but are unlikely to face tailwinds. Factoring in revenue growth, margins, and share count, one need not be apocalyptic about earnings-per-share growth in the years ahead to recognize that the best case scenarios are still not overwhelming. They are moderate if one is an optimist, neutral if one is a realist, and difficult if one is a pessimist.

- Change in multiple—Now for the whammy! How do we really drive total return for the index, especially if earnings per share are moderate or even subpar? A growing P/E, of course. And this is where I remain mystified at those who would mathematically deconstruct the best case scenarios for the index, and still come away sanguine. Starting with a 22X multiple is no way to bank on multiple expansion for the years ahead. The realities of the macro headwinds that John describes scream for multiple contraction. The paradigm of any rate environment not like the ZIRP and QE of the last decade indicates at the very least a moderately lower multiple, not an expanding one. The inescapable mathematical conclusion of a 60/40 or straight index portfolio is that multiples will need to expand, and my friends, they won’t.

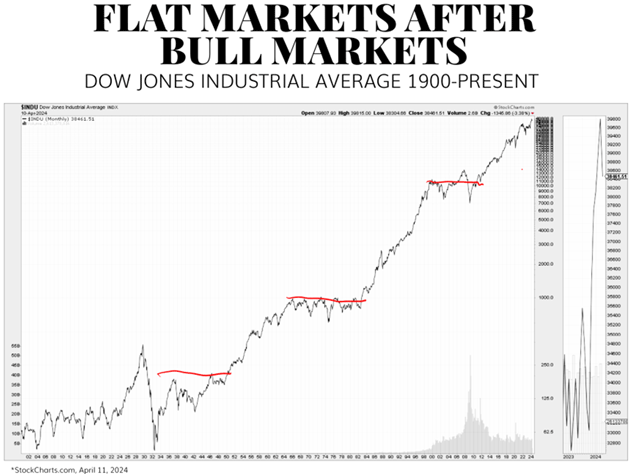

The conclusion I would offer out of analyzing the key parts of an index for the decade ahead, rooted in fiscal recklessness, unintended consequences, monetary excess, downward pressure on the rate of growth, misguided allocation of resources (due to both fiscal and monetary policies), and geopolitical uncertainties, is that the market faces an extended period of “flattish” and choppy returns, in the best case. The historical record is clear: Extended and impressive bull markets are followed by multi-year periods of consolidation. They don’t always feel like they are “flat” when you are living through them, because the up and down volatility from a starting point to an ending point can be massive. But investors cannot have their financial needs met waking up one day at the same spot they were five or 10 years earlier (and some may say I am being optimistic).

Source: David Bahnsen

But wait, I skipped something! Remember our formula above?

Earnings per share growth * Change in multiple + Dividend yield

TR = ((1+EPS) * (1+PE)) + DY

The DIVIDEND YIELD (and implied in this is not merely the starting yield but the growth of dividends paid year by year as well)… Let’s revisit something about index investing versus our chosen path of active, high-conviction, dividend growth investing…

Remember margin expansion? The entire index is a sum of parts of everything, where we know some companies expand margins and some do not. A dividend growth strategy may allow you to focus on where margins are compelling enough that profits are repeatable. How do we know this? They prove it to us… with the dividend payment! Management votes on margin expansion by paying the dividend.

A dividend is money that leaves the company checking account and goes to yours. A change in multiple adds no money to your account. A restatement of goodwill vs. impairment charges adds no money to your account. A reduction of share counts adds no money to your account. No accounting wizardry reduces the cash the company has. A dividend is real money leaving its real account to go to your real account. The analogy I have used for 15 years is individuals with their tax returns. When a person pays real tax dollars to the government, they may very well have made more money than they say, but they sure as hell didn’t make less! Real dollars set the baseline for real economic results. A dividend is a communication from management: “This much of our results is real.”

But most important, multiple expansion. An index investor has no control over the P/E ratio of the market. The multiple goes up or down around sentiment, psychology, mood, media, macro, interest rates, headlines, and so forth and so on. It is literally the most important ingredient in the investment result for an index investor, yet it is completely controlled by the wind.

The dividend as a matter of investor focus not only has the benefit of being real and spendable but it is also a factor one can select in their investment management. We can select companies with the ability and propensity to grow their dividend; we cannot select or identify an “ability to grow the multiple.” The valuation just happens; the dividend is something company management has agency over. Apart from significant manipulation that could become subject to inquiry, corporate management is highly limited in how they can drive multiple expansion. But good companies growing free cash flow have a lot of control (actually, all the control) over dividend rewards to shareholders!

It should be no small irony to you that the most uncontrollable and unknowable ingredient in investor return is the one getting all the investor attention these days (either consciously or unconsciously)—multiple expansion. Growing P/E ratios are exciting and those accelerated returns are fun. They also are fleeting, and as it pertains to the market conditions we face in the years ahead, they are not worth taking for granted. Adding to the irony of the moment is that the one ingredient that investors can know and control within their portfolios (within reason, and enhanced by quality research and management), is the dividend. The controllable gets ignored and the uncontrollable gets attention. This is not the formula for playing offense in the years ahead.

Even apart from the cliché adage (which can be extremely true) that the “best offense is a good defense,” dividend growth investing is uniquely positioned for the years ahead. It puts the mathematical focus in generating a total return off of the vulnerable (multiple expansion) and on to the controllable (cash flows). It redirects portfolio focus to those goods and services in our economy that are needed, that are used, that are not faddish and fleeting, and where the very people running the company have so much confidence in the ongoing prospects that they choose to write a check with real money.

Only unlike in my taxpayer analogy above, this time, the check goes to you. And you will know how to spend it.

***

John here to close: one point. The return contributions chart above was for the S&P 500. If you take the dividend all-stars David (or other likewise brilliant analysts) selects, you get far higher dividends and reduced volatility.

And as I finish, I got this email from my friend Ed Easterling underscoring some of David’s points: “The stock market is up 28% since the first quarter of 2023 while the latest 12 months’ earnings are up 9%.” That can’t continue. Price is like a voting machine. Earnings are like a weighing machine.

I like what I see in dividend growth as a path forward. Think about checking it out.

DC, Cape Town, Italy, and London

I will be in Washington, DC, as you read this and then back home Tuesday. Lots of cool dinners and meetings, as well as a long update on a promising new anti-aging drug. Shane and I will be going to Cape Town, South Africa, in early June and then spend some time in Italy (the Amalfi coast?) and London.

Longtime readers know that I was very active in the Texas Republican Party for decades, from precinct up to state level. I chaired most of the state committees at one time or another, was a national delegate, and more. So I am somewhat embarrassed to admit that Shane and I just registered to vote here in Puerto Rico. We should have done it the first year.

It was pretty easy, all electronic, etc., though I will say they take registration and voting seriously. I have opened bank accounts providing less information. Driver’s license, passport or birth certificate, utility bill, Social Security number. They wanted to know who my parents were and where they were born. Did I have a twin? They took pictures of all my docs, then my picture to put on the voting card.

I remember registering people in Texas with a lot less. And wonder what the agenda is of people who don’t think there should be voter IDs.

It is time to hit the send button and wish you a good week. Full disclosure: I did not mention my evil twin Skippy when I registered, but you all know him. He is the one who makes those bad forecasts and typos.

Your ready to vote analyst,

|

|

John Mauldin |

P.S. If you like my letters, you’ll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price.

Click here to learn more.